how to calculate cash assets

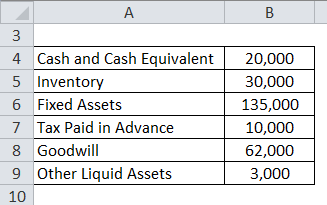

To calculate the total value of the assets in this category you can follow these steps. Add the value of anything you own that you can sell for cash in the future.

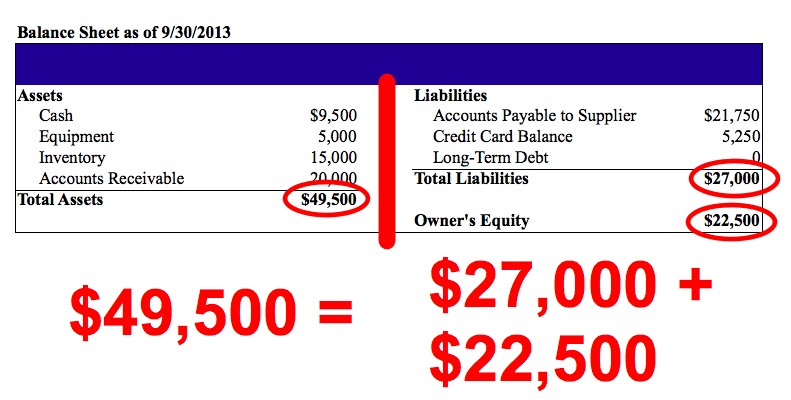

The Accounting Equation Student Accountant Students Acca Global

Add the three amounts to determine the cash flow from assets.

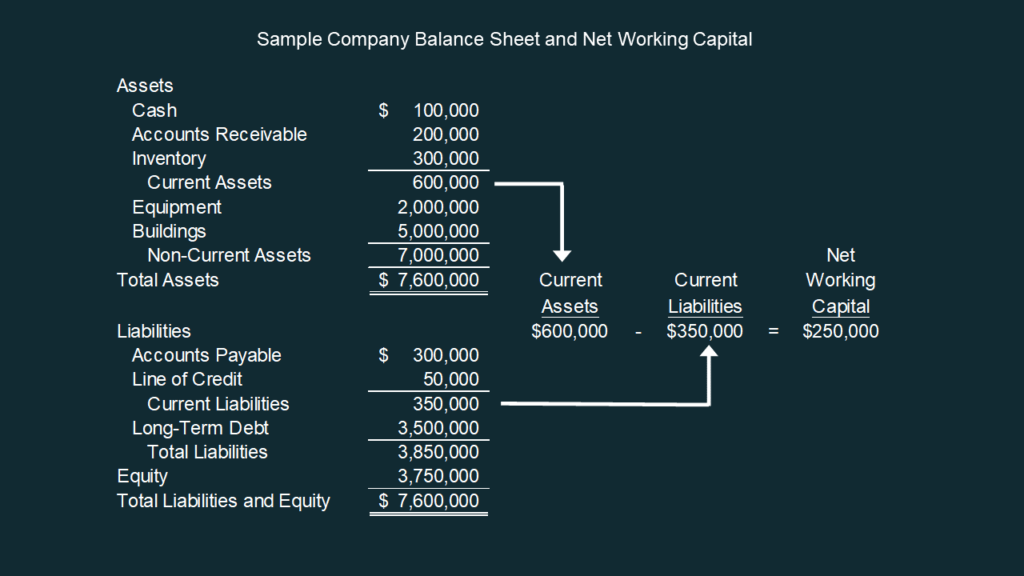

. You can calculate it by taking the cash on hand and adding accounts receivable funds as well as any other assets that can be converted to cash quickly. In this case the amount is the. Total Assets Non Current Assets Current Assets.

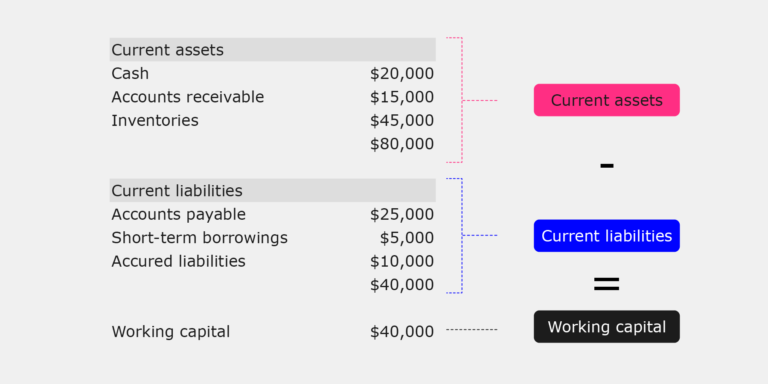

Current Assets Current assets refer to. Cash Flow From Assets f - n - w Where f Operating cash flow n Net capitalspending w Changes in net working capital. Cash includes legal tender coins and currency and demand deposits checks checking account bank drafts.

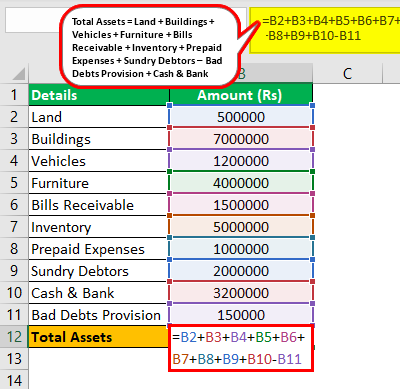

Here are a few steps for calculating total assets. Calculate your current assets. 24000 -10000 2000 16000.

Johnson Paper Companys cash flow from assets for the previous year is. As a result calculating the average total assets for the period in question is more accurate than the total assets for one period. How to calculate total assets.

One must have knowledge about whether the. Add up the total number of assets the company owns. The first step to calculating TA is the identification of all assets.

Heres the formula for obtaining your quick ratio. A companys total assets can be found on the. To calculate TA following steps must be followed.

How to calculate the cash surrender value of life insurance differs from policy to policy and is specified in the policy document. If a companys balance sheet shows total assets of 100000 and total liabilities of 60000 then its debt-to-asset ratio would be 60000 100000 06 or 60. This total is then divided by current.

Current ratio Current Assets Current Liabilities Quick ratio Current Assets Inventory Prepaid Expenses Current Liabilities Net. Collect asset values in each type. To calculate a companys current.

Instead of looking at your total current assets a quick ratio only considers assets that can be converted to cash within 90 days. One can also take a total of. Operating Cash Flow Operating Income Depreciation Taxes.

The formula for Total Asset is. Find the gross assets. You can follow these steps to measure a companys non-cash working capital using its current assets.

A simple equation on the other hand can be as. If you are going to buy more short-term. Here are the steps necessary for calculating net fixed assets.

Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure. How to calculate current assets. The common size percent for cash formula requires you to take the amount and divide it by the base amount before multiplying it by 100 percent.

Anytime that the purchase of a long-term asset occurs it reduces company cash flow from assets while the sale of a long-term asset increases cash flow. The first step in calculating this value is to find out. The formula for calculating the cash ratio is as follows.

The first step in calculating the cash flow from assets would be a separation of assets into two types. This results in the following cash flow from assets calculation. First we need to calculate the total of assets on the right side of the balance sheet.

We need to cover below three steps and then we will have Net Asset value. 12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in. The owner of a.

Accounting Equation Purchase And Loan Accountingcoach

How To Calculate Working Capital With Calculator Wikihow

What Are Current Assets Formula Examples Calculation Video Lesson Transcript Study Com

How To Read A Balance Sheet The Non Boring Version

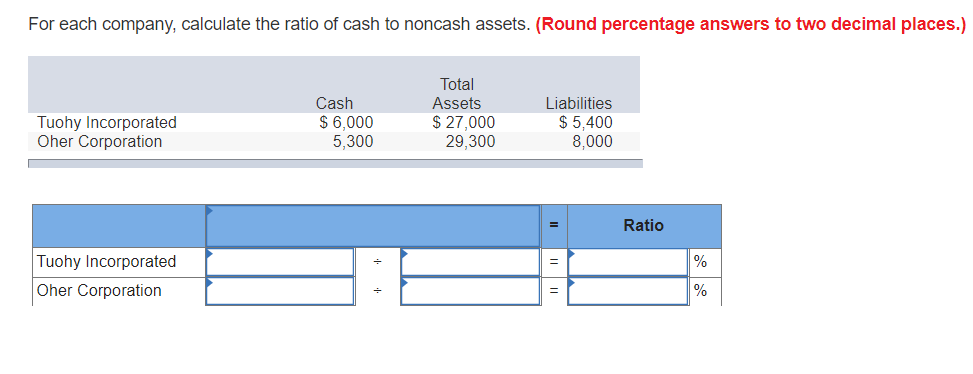

Solved For Each Company Calculate The Ratio Of Cash To Chegg Com

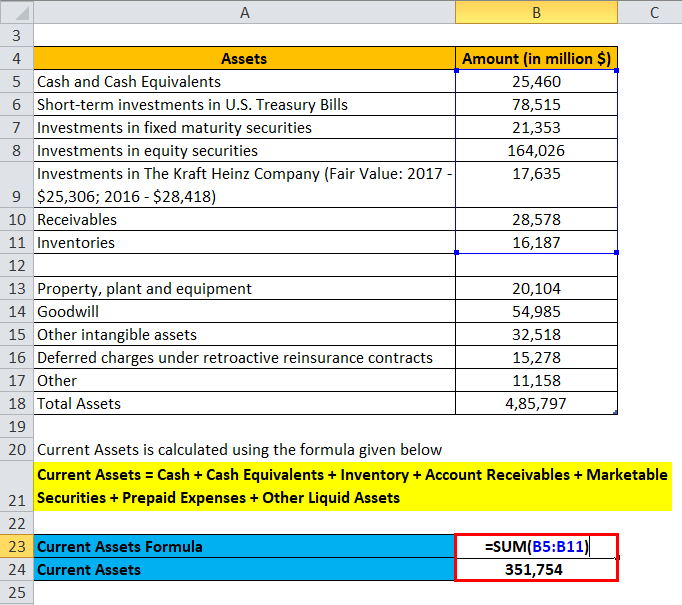

Current Assets Formula Calculator Excel Template

Current Assets Formula Calculator Excel Template

What Financial Liquidity Is Asset Classes Pros Cons Examples

/InvestoApple2jpeg-da0c6b0acbc7478d9df0caf561ad0afc.jpg)

Balance Sheet Vs Cash Flow Statement What S The Difference

How To Calculate Current Assets How It Can Increase Your Business S Value In 2022 Signpost

Understanding Cash Flow Analysis Ag Decision Maker

How To Calculate Initial Investment Operating Cash Flow Terminal Cash Flow For Capital Budgeting Youtube

Solved Consider The Following Abbreviated Financial Chegg Com

Net Working Capital Formulas Examples And How To Improve It

Accounting Basics Purchase Of Assets Accountingcoach

Current Ratio Business Tutor2u

How To Calculate Goodwill 2021 Bankingprep

Total Assets Formula How To Calculate Total Assets With Examples